Superbill

A superbill is an invoice that itemizes specific information regarding services provided to a client by a therapist. Therapists may offer superbills to clients when they are awaiting credentialing from an insurance company, are not accepting insurance from a specific insurance company or own a practice that does not accept insurance at all. In other words, therapists primarily provide superbills for clients seeking out-of-network reimbursement from their insurance company for your services.

Summary

- Understanding insurance billing helps therapists submit cleaner claims and reduce the likelihood of denials or delays. Enrolling in an insurance billing course for therapists can help providers enhance their knowledge.

- Staying informed about current coding rules and regulations helps maintain compliance and avoid costly errors.

- Familiarity with billing procedures, modifiers, and documentation can streamline administrative tasks and boost efficiency.

- Accurate billing leads to timely reimbursements, which can positively impact the financial health of a therapy practice. Also, leveraging an EHR like TheraPlatform for efficient documentation and claim submission, therapists can maintain accurate records.

→ Click here to enroll in our free on-demand Insurance Billing for Therapists video course [Enroll Now]

Most therapists who provide superbills for their clients, receive payment for the agreed-upon rate from their clients with each session.

Understanding superbills and how to use them for your practice are important aspects of billing. This article will help you learn more about superbills and how to integrate them into your practice.

Streamline your insurance billing with One EHR

- Claim batching

- Auto claims

- Automated EOB & ERA

- Real-time claim validation

- Real-time claim tracking

- Aging and other reports

What is superbill used for?

A superbill is a document created for insurance companies that details information about provided therapy services, superbills differ from a statement, receipt, or invoice, however, in that these types of documents list the charges and payments received on the account. The superbill itemizes information for the insurance company.

Additionally, the process for superbills is a little different in that the client typically submits the superbill to their employer, insurance company, or health care savings account (HSA) in order to receive reimbursement at the out-of-network rate for the sessions.

Watch this video covering all you need to know about superbills

→ Download My Superbill Template

→ Start My Free Trial of TheraPlatform

How do I generate a superbill for insurance?

Because a superbill communicates specific and important information to the insurer, it is important to include the correct information. Creating a template for your superbill for insurance can simplify the process for you. Because different insurance companies might require specific information, you can create a template that incorporates the general information that any insurance company would request rather than having a separate form for each insurance company.

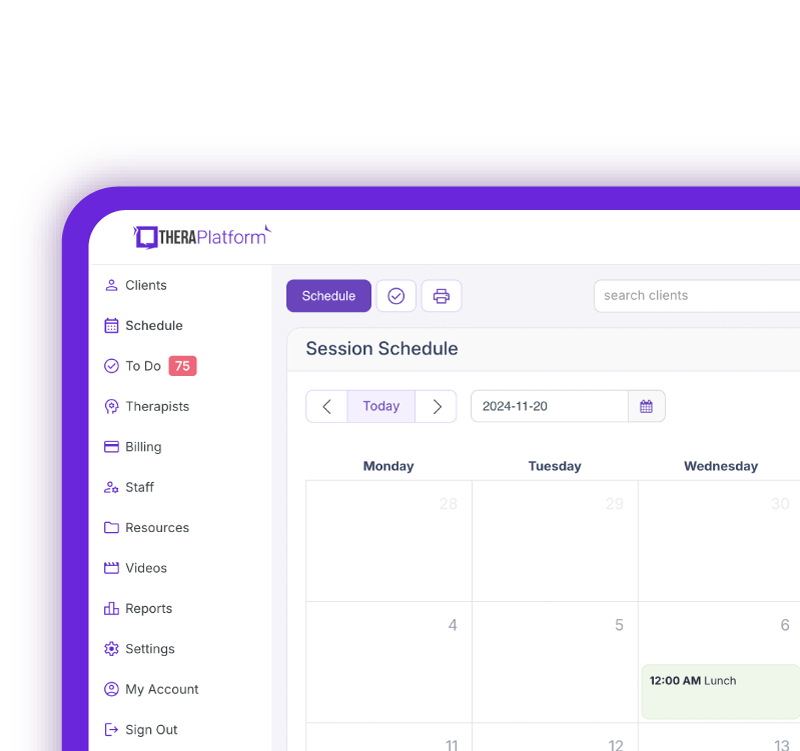

How an EHR like TheraPlatform helps in generating superbill

EHRs like TheraPlatform generate superbills automatically which eliminates manual data entry, improves accuracy and saves time. You can also securely send superbills directly to clients.

To prevent any delays of payment and decrease the chance of rejection of the claim, you can ensure that your superbill for insurance contains all of the necessary information that an insurance company would request.

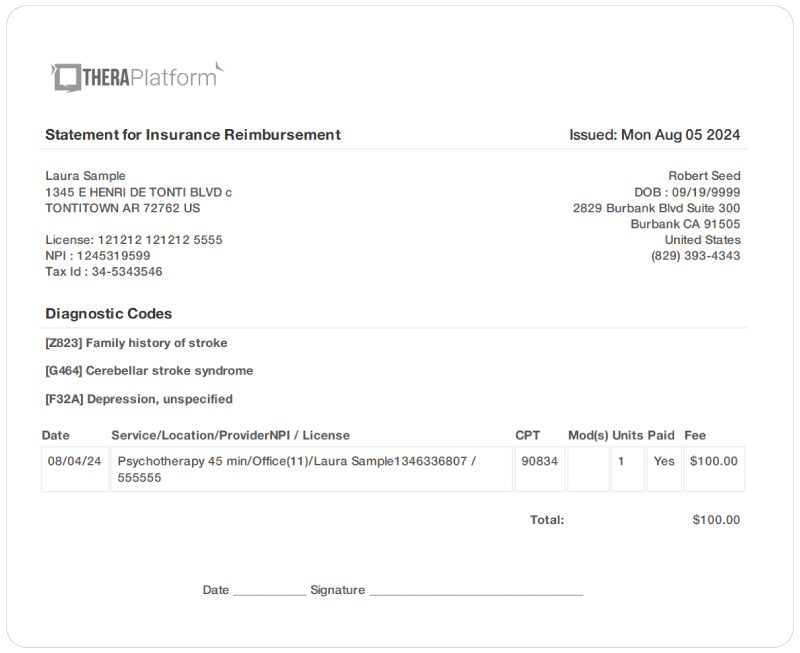

What information is needed on superbill

Client information for a superbill for insurance

- Client’s name: Include the first and last name associated with the insurance plan

- Client’s date of birth: List the date of birth in day, month, and year format

- Client’s diagnosis: A billable diagnosis from the DSM-V using ICD-10 coding

- Client contact information: Use the address and telephone number associated with the insurance plan

Billing and procedure information for a superbill

- Procedure code with appropriate modifier(s): Enter the correct Current Procedural Terminology (CPT) code or Healthcare Common Procedure Coding System (HCPCS) associated with the billable procedure or service provided. Most insurance companies use CPT codes but some plans, such as Medicaid plans, may use HCPCS codes.

- Service description: Write a short description of the service or procedure performed. If the service was telehealth, include the format (phone or video).

- Billable units for each procedure code: CPT codes usually consist of one unit per billable service. Most HCPCS codes assign units to fifteen-minute increments.

- Billable amount for each procedure: Enter your usual and customary charge for the service provided

- Date: The date of the service provided

- Place of service code for each procedure: Where was the service performed? Was it telehealth or in-person?

- Credit or payments made: Identify any payments the client has made toward the account

- Balance due: Remaining balance owed on the account

Watch this video to learn common insurance billing struggles and solutions

→ Start My Free Trial

→ Start My Free Trial

Provider information for a superbill for insurance

For the provider’s contact information, include all possible and necessary contact information for the provider and the practice:

- Provider’s first and last name

- Practice name

- Practice service address

- Practice billing and mailing address (if different from service address)

- Contact phone number(s)

- Fax number

- Email address

- Employer identification number (EIN): Include the EIN for the provider and the practice if it differs.

- National provider identifier (NPI): When billing insurance, in-network or out-of-network, you need an NPI associated with the provider.

- Therapist’s name and signature: Provided a printed name as well as signature (can be an electronic signature)

- Licensure information: Include the state, license, license number, and type of license (ex.: FL LMHC 1234, Licensed Mental Health Counselor)

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

How to use the superbill with clients

When your practice does not accept a client’s insurance, providing a superbill for the client is an option, but it is not mandatory. It’s up to you to determine whether offering superbills is right for your business.

If you decide to offer superbills, discuss this process with your clients before initiating services and again upon intake.

When discussing superbills and your practice policy regarding out-of-network billing procedures with your client, encourage your client to contact their insurance provider to inquire about their out-of-network benefits and how to submit for reimbursement.

Due to HIPAA regulations, the insurance plan cannot discuss the client’s benefits and eligibility with an out-of-network provider. The client must make this call.

Once you have created the superbill for insurance, you have a few choices on how to proceed. It is important to decide what works best for your practice.

- Client-submitted forms: The therapist provides a copy of the superbill to the client, the client contacts the insurance plan and follows through on submitting the claim. The client may need to attach the superbill to a form provided by the insurance company or the employer.

- Clinician-submitted forms: The therapist submits the superbill to insurance on behalf of the client. In this option, you need to have the correct information from the plan regarding how and where to submit the claim.

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

What are the benefits of a superbill?

There are some benefits for your practice and for your client if you decide to provide superbill for insurance:

- Increased referrals: When you provide clients an opportunity to receive reimbursement from their insurance company for counseling, you may attract more potential clients to your practice.

- Increased access to services: Some people may not be able to afford your services without seeking reimbursement from their insurance companies. When you offer the option for reimbursement, then more clients can access your services to get the help they need.

- Decrease paperwork for your practice: As an out-of-network provider, you decrease the paperwork required for your practice including:

- Insurance credentialing paperwork or re-credentialing paperwork

- Billing insurance companies

- Bookkeeping related to insurance claims

- Reduced overhead: As an out-of-network provider, you need to pay for software or services related to billing insurance claims.

- Immediately receive payment: With a practice that does not bill insurance, you can receive payment for your services immediately upon providing the service. You do not need to wait for an insurance company to pay the claim.

Drawbacks to using superbills for insurance

If you are contemplating offering superbill for insurance for your practice, there are some disadvantages to consider:

- The insurance company may need to review the client record: When the client submits a superbill, they are asking the insurance company to pay for the service. This request opens the door for the insurance company to review the treatment record, notes, etc. for medical necessity.

Consequently documentation must meet the standards and requirements of the insurance company. If you provide superbills, familiarize yourself with documentation guidelines to ensure that you write appropriate notes, treatment plans, assessments, etc.

- Client confusion over reimbursement: Another drawback can occur when a client does not understand the out-of-network benefits of their plans. A client might expect to receive a certain amount of reimbursement from their insurance plan but receive a much lower amount, if any reimbursement.

Help your clients by providing them with a form that indicates what they need to ask of their insurance company related to your services. You can review this information with the client to ensure their understanding of payment responsibilities and the amount of reimbursement they will likely receive.

How EHR and practice management software can save you time with client and insurance billing for therapists

EHR with integrated billing software and a clearing house, such as TheraPlatform offers significant advantages in creating an efficient insurance billing process. The key is minimizing the amount of time dedicated to creating, sending and tracking medical claims through features such as automation and batching.

What is automation and batching?

- Automation refers to setting up software to perform a series of tasks with limited human interaction.

- Batching or performing administrative tasks in blocks of time at once allows you to perform a task from a single entry point with less clicking.

Which billing and medical claim tasks can be automated and batched through billing software?

- Invoices: Create multiple invoices for multiple clients with a click or two of a button or set up auto-invoice creation and the software will automatically create invoices for you at the preferred time. You can even have the system automatically send invoices to your clients.

- Superbill: Create superbills and securely send them to clients for higher accuracy and efficiency.

- Credit card processing: Charge multiple clients with a click of a button or set up auto credit card billing and the billing software will automatically charge the card (easier than swiping!)

- Email payment reminders: Never manually send another reminder email for payment again or skip this all together by enabling auto credit card charge.

- Automated claim creation and submission: Batch multiple claims with one click of a button or turn auto claim creation and submission on.

- Live claim validation: The system goes over each claim to catch any human errors before submitting, saving you time and reducing rejected claims.

- Automated payment posting: Streamline posting procedures for paid medical claims with ERA. When insurance offers ERA all the payments from them will be automatically posted on TheraPlatform’s EHR.

- Tracking: Track payment and profits including aging invoices, overdue invoices, transactions, billed services, service providers.

Utilizing billing software integrated with an EHR and practice management software can make the storage and sharing of billing and insurance an easy decision and can save providers time when it comes to insurance billing for therapists.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports mental and behavioral health, SLPs, OTs, and PTs in group and solo practices.

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Mental health credentialing

- Insurance billing 101

- Practice management tools

- Behavioral Health tools