Private practice income options for PTs

Physical therapy income options are more diverse than ever. Hospital-based outpatient clinics, inpatient hospitals, skilled nursing facilities, athletic groups, inpatient rehab, home health and private practice are just some of the setting options for physical therapists. There are many things to consider when selecting your practice setting but for many PTs, finances top the list.

Summary

- Physical therapists have diverse income opportunities, from hospital-based roles to private practice, each with unique financial considerations.

- Private practice PTs can increase earning potential through insurance billing, cash-pay services, and specialized offerings like injury prevention and wellness programs.

- Credentialing with insurance providers is essential for those accepting insurance, while cash-pay PTs must strategically price services and offer superbills for reimbursement. Enrolling in an insurance billing course for therapists can help providers enhance their knowledge.

- Effective marketing, financial planning, and automation tools like EMR/EHR systems help PTs build and sustain a profitable private practice.

→ Click here to enroll in our free on-demand Insurance Billing for Therapists video course [Enroll Now]

While all of these practice settings offer different employment packages, PTs looking to enter the private practice realm benefit from a diverse income stream and thoughtful preparation.

With consumer prices increasing 20% since 2020, most Americans feel the squeeze on their wallets.According to a survey disseminated by Rizing Tide, a scholarship program designed to empower a new generation of BIPOC leaders in the physical therapy profession, nearly half of their scholars will graduate with at least $100,000 in student loan debt.

While most PTs enter the profession because of a love for science, sports, healthcare and helping people, they also need to earn a considerable salary to manage their debt, keep up with inflation and have some left over for savings and leisure activities.

Many PTs recognize the benefits of opening a private practice and in this article we will explore physical therapy income options and the steps needed to bill insurance, considerations for cash-pay PTs and strategies for marketing your business.

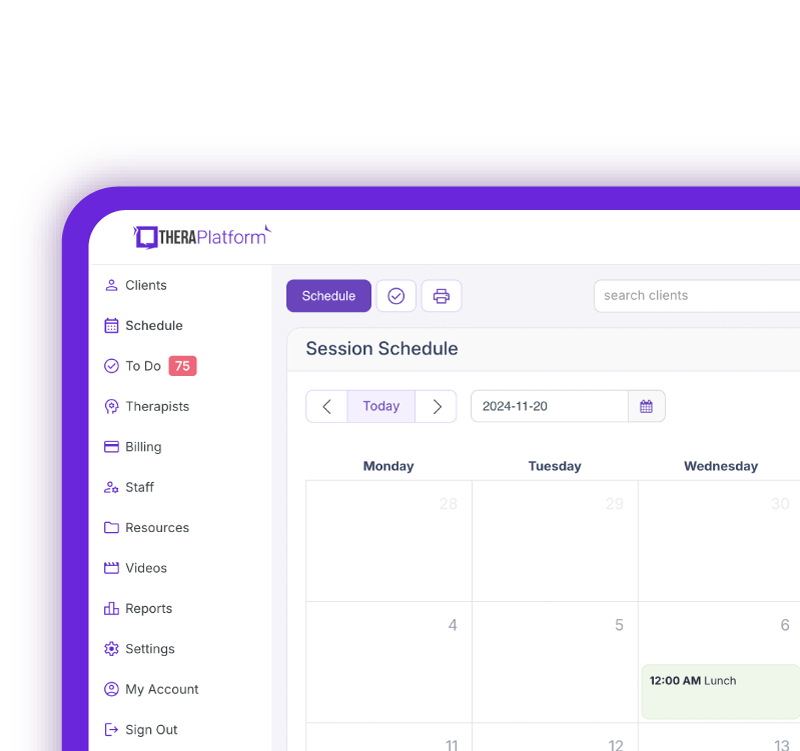

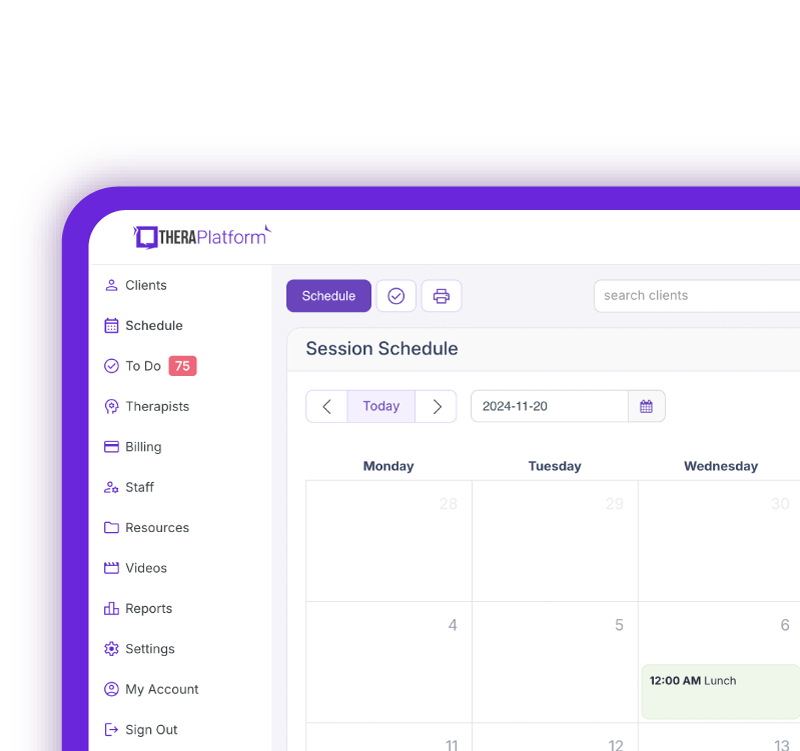

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Introduction to insurance billing

Credentialing is your first step if you plan to accept health insurance as a physical therapy income option. Credentialing is the process of becoming accepted into an insurance plan’s preferred network of providers and negotiating a contract of rates.

Through this process, you will prove to each insurance company that you are worthy of being one of their in-network providers. If you have employees you need to credential each of your providers to be reimbursed by the insurance company. This process can take up to 4-6 months so beginning the credentialing process early is essential if you want to start accepting insurance.

Practice Management + EHR + Telehealth

Mange more in less time in your practice with TheraPlatform

.

Contracting with a credentialing service provider is an option for private practice owners who do not want to spearhead this process independently. These credentialing providers are familiar with the requirements and processes for individual insurance plans and can take the guesswork out of the process. Once accepted as an in-network provider for an insurance plan, you can bill them for patient care services. Over time you can negotiate better rates.

Before treating a patient, verify their insurance benefits (usually through electronic benefits authorization (EBA). Some insurance plans require authorization before or after the initial evaluation and you don’t want to miss this step. Once you are familiar with the patient’s benefits, you can choose to treat them.

Next, complete documentation that includes relevant ICD-10 codes, CPT codes and modifiers for each patient encounter. Then, you can formulate and submit a claim to the patient’s insurance. A clean claim, whether paper or electronic means that it is accurate, complete, and legible (if a paper claim).

If you use a claims clearinghouse, they will verify the claim is clean and then submit it to the insurance company. If they notice missing information they will “reject” the claim and send it back to the therapist to amend or correct. Utilizing a claims clearinghouse or billing software integrated with your EMR/EHR software makes this process much easier. TheraPlatform is a great option for streamlining documentation and billing practices.

Free Resources for Therapists

Click below and help yourself to peer-created resources:

Cash pay

Many PTs are opening cash-pay private practices as a physical therapy income option and foregoing the limitations and restrictions of insurance contracts altogether. This choice eliminates some of the challenges of dealing with insurance contracts but introduces the complexities of billing patients directly and managing the finances of a cash-pay practice.

Below are some factors you want to consider ahead of opening your doors using a cash-pay service as a physical therapy income option.

- Create a business plan that outlines all of your one-time, yearly, quarterly, monthly and weekly expenses

- Create a method for tracking expenses and income

- Develop a list of services and price them competitively but in a way that ensures you can cover costs

- Purchase an EMR/EHR and billing software like TheraPlatform to help you bill patients, post payments and reconcile payments owed

- Consider accepting FSA and HSA payments

- Create a process for providing superbills that clients can submit to their insurance companies as an out-of-network service

- Audit your income and expenses regularly to ensure you are meeting or progressing toward your financial goals

- Consider hiring a financial advisor or business coach to help you optimize your processes

While not all patients can afford cash-pay physical therapy, among those that can, private-pay physical therapists can provide a wide array of services.

Let’s list some services you can offer to diversify your physical therapy income stream:

- Evaluation and treatment of patients recovering from illness or injury

- Prehabilitation services for athletes or those planning to undergo surgery

- Wellness services to promote elements of health and overall fitness

- Injury prevention seminars

- 1:1 or team athlete consultations

- Ergonomic evaluations

- Bike fittings for cyclists

- Running evaluations

- Swimmer evaluations

- Creation of online rehab protocols clients can purchase online

- Working at sporting events to evaluate and treat athletes

- Contracting with a performing arts center

Hopefully, this list has expanded your vision of physical therapy income options through private practice. While running a private practice takes a lot of work, it can circumvent one of the biggest struggles many PTs face when working for a hospital or group practice, boredom or lack of variability in their work duties.

Marketing your physical therapy practice

Private practice physical therapists rely on good marketing to build their businesses. Marketing strategies should target patients, clients and referral sources that need your services.

If no one knows your practice exists, it is hard to earn a sustainable living.

- Consider hiring a marketing team to spread the word

- Create a website and social media presence that reaches a large audience in your target locations and demographics

- Create an informational pamphlet or flyer and disseminate it to physicians, surgeons or potential patient/client groups that might refer clients to your business

- Volunteer at local events or offer to give talks to groups that could become clients

- Ask happy customers to leave you Google reviews

Plan for success

Owning a private practice can bring autonomy, joy and enthusiasm to the career of many PTs. For those willing to take on the challenge, planning ahead is the key to success. Reinventing the wheel is rarely the best move so don’t be afraid to buy your favorite private practice business owners a cup of coffee and ask about their own successes and failures. Outline your strategy physical therapy income including insurance credentialing or plans for cash-pay services and combine your passions and strengths to help meet your financial goals.

Consider working with a credentialing service and purchasing integrated and comprehensive EMR/EHR and billing software like Theraplatform to handle various physical therapy income options such as cash-pay and insurance clients and spread the word about your presence and the great services you offer.

Streamline your practice with One EHR

- Scheduling

- Flexible notes

- Template library

- Billing & payments

- Insurance claims

- Client portal

- Telehealth

- E-fax

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports different industries and sizes of practices, including physical therapists in group and solo practices.

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Insurance billing 101

- Practice management tools