Timely filing limits

Timely filing limits – the numerous deadlines and responsibilities associated with making insurance claims – need to be monitored and adhered to for therapists who take insurance.

And while most therapists didn’t enter the mental health profession because they enjoy billing, they do expect to get paid for their work.

Summary

- Each insurance provider has its own timely filing limit, ranging from 90 days to a year, making consistent billing practices and deadline tracking essential.

- Therapists should set reminders for each timely filing limit including end-of-year benefit resets, reauthorizations, and client FSA/HSA usage to avoid gaps in coverage and maximize payments.

- Denied or rejected claims require prompt appeals or resubmissions, and billing software can streamline error-checking, tracking, and appeal templates.

- Staying compliant with Medicare/Medicaid reporting, credentialing renewals, and CAQH attestations ensures ongoing eligibility for reimbursement and contract stability. Watch our video on insurance credentialing for more information.

→ Click here to enroll in our free on-demand Insurance Billing for Therapists video course [Enroll Now]

Here are some of the primary considerations for timely filing limits when filing insurance claims on behalf of your clients and what you can do to ensure you get paid on time.

What is a timely filing limit?

All insurance plans, whether private or government-controlled, have a timely filing limit or deadline. In other words, the therapist (or biller) usually has anywhere from 90 to 365 days from the date of service to file for reimbursement. For example, Medicare allows one year from the date of service to file a claim, while Cigna allows 90 days. With numerous cases, it is not uncommon for therapists to miss a filing date. Here is what you can do to prevent missing the timely filing limit or deadline.

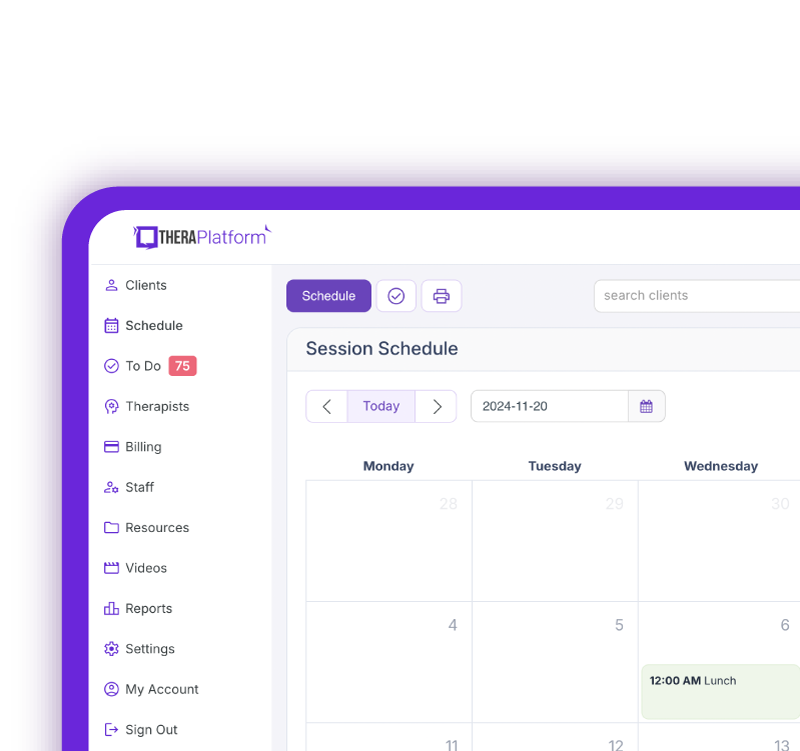

Streamline your insurance billing with One EHR

- Claim batching

- Auto claims

- Automated EOB & ERA

- Real-time claim validation

- Real-time claim tracking

- Aging and other reports

Timely filing limit action plan for private and government insurance

- Run reports to catch unbilled sessions. Most billing software will help you organize relevant data into a structured format that is easy to examine for errors.

- Keep a reference sheet for filing deadlines for each insurance you accept. You can easily determine which insurance companies have the shortest deadlines. This will allow you to file claims with the shortest deadlines first.

- Keep proof of submission. When filing electronically, you can see that your claim was submitted and track your claim status online.

- Develop a billing routine. Consistent billing practices considerably cut down on missing submission deadlines. For example, setting a regular time to review and complete billing from the previous week will likely reduce errors.

End of benefit year

Many plans follow a calendar year (Jan 1 – Dec 31) benefit structure, which means clients must use their benefits before deductibles and out-of-pocket maximums reset on New Year’s Day.

Also, insurance companies often review their policies each year and may make changes to coverage and copays that affect eligibility. Further, some treatment authorizations expire at the end of the year and require the therapists to reauthorize therapy services.

Timely filing limit action plan for end of benefit year

- Remind clients of annual benefit resets. While it is not the therapist’s job to ensure that clients use their benefits before they expire, they can easily remind them of end-of-year limits and ask them to review any changes to their policy. Because almost all insurance plans reset deductibles at the end of the calendar year, individual knowledge of clients’ insurance plans is not necessary.

- Therapists should send themselves a reminder in November for potential end-of-the-year reauthorizations. If you wait until December, there is a risk of a lapse in coverage.

Watch this video to see how TheraPlatform’s EHR saves time on insurance billing

Outstanding claims and rejections

It would be helpful if insurance companies paid all claims promptly without any resistance.

However, it is quite common for them to reject and fail to pay claims for various reasons. Unpaid or denied claims usually require appeals and resubmissions. Most insurers allow six months from when you receive a denial to file an appeal. Complete resubmissions due to errors as soon as possible.

Action plan for outstanding claims and rejections

- Take your time. Many claims are rejected due to billing errors, including incorrect codes or missing information. Being thorough and accurate can significantly reduce insurance-related headaches.

- Develop templates for common denial reasons and save time when filing appeals.

- Rely on your billing software. Billing software can send you status alerts for incomplete claims and appeals.

FSA/HSA usage

Flexible spending accounts (FSA) and health spending accounts (HSA) are great ways to reduce tax burden. However, money in flexible spending accounts is “use it or lose it”; if the money in the account is not spent before December 31st, it goes back to the employer. HSAs, in contrast, roll over year-to-year and are not subject to the yearly deadline.

Action plan for FSA/HSA usage

- Send reminders to clients in November to use remaining FSA balances for eligible therapy services.

Medicare and Medicaid reporting

If you’re a Medicare or Medicaid provider, you may face reporting requirements specific to those government insurance programs. For example, providers who accept Medicare Part B may have to submit reports for the Merit-based Incentive Payment System (MIPS).

This is due in March of the following year. Providers also need to worry about revalidating their enrollment information (typically every five years), as well as responding to audits promptly (30 to 45 days) when they occur.

Action plan for Medicare and Medicaid reporting

- Understand your specific Medicare and Medicaid responsibilities and set reminders for filing those reports by their deadlines.

Practice Management + EHR + Telehealth

Manage more in less time in your practice with TheraPlatform

Credentialing and contract renewals

Keeping track of renewals with private insurance carriers might seem to be a challenging prospect. However, certain tools make it easier than it sounds. Once you are on an insurance panel and have a contract, renewal of that contract is usually a formality. The insurance company will notify you well in advance. This is the time to renegotiate your contract if you feel justified. However, if you wish to terminate a contract, you will need to do so in writing.

Most private insurance companies use the Council for Affordable Quality Healthcare (CAQH) for credentialing and renewal services. CAQH collects and maintains all your relevant credentialing information.

As long as you keep it up to date, you don’t usually need to deal with the private insurance companies individually. It is a quite helpful—and required—resource for therapists who accept private insurance.

Action plan for credentialing and contract renewals

- If you wish to terminate a contract with an insurance carrier, notify them in writing 60-90 days in advance.

- Re-attest with CAQH every four months. This won’t be hard to remember. They will remind you constantly until you do it.

Accepting clients who use insurance sometimes feels like jumping through hoops. It can be a challenge to meet all the requirements and deadlines set forth by different insurance providers. However, a therapist who has a plan to manage the numerous reporting and filing responsibilities will be able to successfully navigate the insurance landscape and receive prompt and accurate payment.

Practice Management + EHR + Telehealth

Manage more in less time in your practice with TheraPlatform

How EHR and practice management software can save you time with insurance billing for therapists

EHRs with integrated billing software and clearing houses, such as TheraPlatform, offer therapists significant advantages in creating an efficient insurance billing process. The key is minimizing the amount of time dedicated to developing, sending, and tracking medical claims through features such as automation and batching.

What are automation and batching?

- Automation refers to setting up software to perform tasks with limited human interaction.

- Batching or performing administrative tasks in blocks of time at once allows you to perform a task from a single entry point with less clicking.

Which billing and medical claim tasks can be automated and batched through billing software?

- Invoices: Create multiple invoices for multiple clients with a click or two of a button or set up auto-invoice creation, and the software will automatically create invoices for you at the preferred time. You can even have the system automatically send invoices to your clients.

- Credit card processing: Charge multiple clients with a click of a button or set up auto credit card billing, and the billing software will automatically charge the card (easier than swiping!)

- Email payment reminders: Never manually send another reminder email for payment again, or skip this altogether by enabling auto credit card charges.

- Automated claim creation and submission: Batch multiple claims with one button click or turn auto claim creation and submission on.

- Live claim validation: The system reviews each claim to catch any human errors before submission, saving you time and reducing rejected claims.

- Automated payment posting: Streamline posting procedures for paid medical claims with ERA. When insurance offers ERA, all their payments will post automatically on TheraPlatform's EHR.

- Tracking: Track payment and profits, including aging invoices, overdue invoices, transactions, billed services, service providers.

Utilizing billing software integrated with an EHR and practice management software can make storing and sharing billing and insurance easy and save providers time when it comes to insurance billing for therapists.

Resources

TheraPlatform is an all-in-one EHR, practice management, and teletherapy software with AI-powered notes built for therapists to help them save time on admin tasks. It offers a 30-day risk-free trial with no credit card required and supports mental and behavioral health, SLPs, OTs, and PTs in group and solo practices.

More resources

- Therapy resources and worksheets

- Therapy private practice courses

- Ultimate teletherapy ebook

- The Ultimate Insurance Billing Guide for Therapists

- The Ultimate Guide to Starting a Private Therapy Practice

- Mental health credentialing

- Insurance billing 101

- Practice management tools

- Behavioral Health tools

Free video classes

- Free on-demand insurance billing for therapist course

- Free mini video lessons to enhance your private practice

- 9 Admin tasks to automate in your private practice

References

Butler, W. (2025). BellMedEx. Timely filing limit for claims in medical billing 2025. https://bellmedex.com/timely-filing-limit-for-insurance-claims/

Carter, W. (2025, February 16). Billing Paradise 24/7. Common behavioral health claim denials. https://www.billingparadise.com/blog/common-behavioral-health-claim-denials/

Healthcare.Gov. Using a flexible spending account (FSA). https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

Health Insurance Marketplace. What’s a health savings account? https://www.cms.gov/marketplace/outreach-and-education/health-savings-account.pdf

U.S Centers for Medicare & Medicaid Services. Quality Payment Program. Learn about MIPS. https://qpp.cms.gov/mips/mvps/learn-about-mips

FAQs about filing limits for therapists

What is a timely filing limit?

It’s the deadline set by each insurance provider for submitting claims—ranging from 90 days to a year from the date of service.

How can therapists avoid missing filing deadlines?

Set reminders, run reports for unbilled sessions, and establish consistent billing routines. Billing software can also track deadlines and claim status automatically.

What happens if a claim is denied or rejected?

Therapists usually have up to six months to file an appeal. Prompt resubmission with accurate documentation and using appeal templates can help secure payment.